nevaserial.online

Prices

Stocks That May Split

:max_bytes(150000):strip_icc()/What-is-a-Stock-Split-Investing-583aa27d3df78c6f6a406024.jpg)

List of Upcoming Stock Split in ; HDFC BANKING ETF, , ; HDFC NIFTY PVT BANK ETF, , ; HDFC SENSEX ETF, , ; GROWINGTON. Because of Apple's stock split history, you can calculate that 1, shares would have turned into , shares today. At a price of $ per share that would. A stock split is a decision by a company's board to increase the number of outstanding shares in the company by issuing new shares to existing shareholders in. See the Online Banking Service Agreement for details. Data connection required. Carrier fees may apply. Investment products offered through MLPF&S and insurance. Stock Split ; 9. 3 for 2. May 21, ; 2 for 1. May 23, ; 2 for 1. May 7, ; 2% Stock Dividend. Mar 20, Stock Splits Calendar ; GLTO Galecto · ; ATPC AGAPE ATP Corporation · ; ABIO ARCA biopharma · Upcoming Stock Splits as of Sep 5th ; TOMBADOR IRON LTD by TOMBADOR IRON LTD. TMBIF · ; Forte Biosciences. FBRX · ; Exicure. XCUR · ; InCapta. INCT · 1. A company may declare a reverse stock split in an effort to increase the trading price of its shares – for example, when it believes the trading price is too. LightInTheBox Holding Co., Ltd. ARCA biopharma, Inc. Matinas Biopharma Holdings, Inc. Discover which stocks are splitting, the ratio, and split ex-date. List of Upcoming Stock Split in ; HDFC BANKING ETF, , ; HDFC NIFTY PVT BANK ETF, , ; HDFC SENSEX ETF, , ; GROWINGTON. Because of Apple's stock split history, you can calculate that 1, shares would have turned into , shares today. At a price of $ per share that would. A stock split is a decision by a company's board to increase the number of outstanding shares in the company by issuing new shares to existing shareholders in. See the Online Banking Service Agreement for details. Data connection required. Carrier fees may apply. Investment products offered through MLPF&S and insurance. Stock Split ; 9. 3 for 2. May 21, ; 2 for 1. May 23, ; 2 for 1. May 7, ; 2% Stock Dividend. Mar 20, Stock Splits Calendar ; GLTO Galecto · ; ATPC AGAPE ATP Corporation · ; ABIO ARCA biopharma · Upcoming Stock Splits as of Sep 5th ; TOMBADOR IRON LTD by TOMBADOR IRON LTD. TMBIF · ; Forte Biosciences. FBRX · ; Exicure. XCUR · ; InCapta. INCT · 1. A company may declare a reverse stock split in an effort to increase the trading price of its shares – for example, when it believes the trading price is too. LightInTheBox Holding Co., Ltd. ARCA biopharma, Inc. Matinas Biopharma Holdings, Inc. Discover which stocks are splitting, the ratio, and split ex-date.

Stock split information ; May 22, , June 19, , % Stock Dividend ; December 19, , January 9, , 2 1/2 for 1 Split ; February 23, , March Stock Split History ; July 20, , August 10, , 4% stock dividend ; May 17, , May 26, , 2-for-1 split in the form of a % stock dividend ; December. would not be entitled to that dividend. The seller of the stock would receive it. However, in a stock split, the NYSE may defer declaring the stock "ex. Stock info ; June 12, , 2/1, Standard Oil ; February 10, , 3/1, Standard Oil ; July 14, , 2/1, Exxon ; May 15, , 2/1, Exxon. What are stock splits? – Stock splits happen when a company increases its outstanding shares to make the stock more affordable to investors. The last NVDA stock split was announced on May 21, , on the announcement date it was trading at $ The split date was July 20th and. It can be the case that a company's stock price may rise immediately after a stock split announcement (due to this management-signaling effect). There is some. How many stock splits and stock dividends has IBM had? The stock split is the 15th IBM stock split. IBM has also had 26 stock dividend distributions. Stock Splits Calendar ; GLTO Galecto · ; ATPC AGAPE ATP Corporation · ; ABIO ARCA biopharma · Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may. Recent Stock Splits ; May 3, , CSCI, Cosciens Biopharma Inc ; May 2, , SGBX, Safe & Green Holdings Corp ; May 1, , VINO, Gaucho Group Holdings Inc ; May. Company Splits, Company Splits Stocks, Company Splits Shares, List Of Company Splits - nevaserial.online You may automatically receive The Home Depot, Inc. financial information by e-mail. To choose your options for e-mail notification, please enter your e-mail. Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may. Split Information. , March 19 — 2-for-1 common stock split. , May 25 — 2-for-1 common stock split. , May 22 — 3-for-1 common stock split. Privacy. Stock splits are generally done when the stock price of a company has risen so high that it might become an impediment to new investors. Therefore, a split is. History Of Stock Splits For The Coca-Cola Company This website may contain statements, estimates or projections that constitute “forward-looking statements”. Amazon went public on May 15, , and the IPO price was $, or $ adjusted for the stocks splits that occurred on June 2, (2-for-1 split). Record Date, Payable Date, Distribution. May, May, 2-for-1 Stock Split. Feb, Mar, 2-for-1 Stock Split. History Of Stock Splits For The Coca-Cola Company This website may contain statements, estimates or projections that constitute “forward-looking statements”.

Uber Driver Average Weekly Pay

Uber's average pay to drivers seems to hover around $$ Average Uber drivers working 20 hours per week would make around $ Does Uber pay for gas? It's easy to get paid. All you need is a bank account. Your earnings are transferred every week. Get paid fast. Saving on driving expenses. Running your own. Average Uber Driver weekly pay in California is approximately $1,, which is 41% above the national average. Salary information comes from data points. These determining variables include when, where and how many hours a week the Uber driver drives. How much do Uber drivers make an hour? On average, Uber. Actual earnings vary, depending on factors like number of trips completed, time of day, and location. Earnings include trip fares, certain promotions (which are. How much can Uber drivers earn in London? ; Average earnings, Side hustle (30 hours per week), Full-time gig (45 hours per week) ; £ per hour, £ per week. $41, is the 90th percentile. Salaries above this are outliers. $39, - $41, 5% of jobs. $42, - $44, 3% of jobs. National Average. On average, Uber drivers make around $19 an hour. In large urban cities, like New York City for example, the average is over $30 an hour. Average Uber Driver hourly pay in the United States is approximately $, which is 15% above the national average. Salary information comes from 1, data. Uber's average pay to drivers seems to hover around $$ Average Uber drivers working 20 hours per week would make around $ Does Uber pay for gas? It's easy to get paid. All you need is a bank account. Your earnings are transferred every week. Get paid fast. Saving on driving expenses. Running your own. Average Uber Driver weekly pay in California is approximately $1,, which is 41% above the national average. Salary information comes from data points. These determining variables include when, where and how many hours a week the Uber driver drives. How much do Uber drivers make an hour? On average, Uber. Actual earnings vary, depending on factors like number of trips completed, time of day, and location. Earnings include trip fares, certain promotions (which are. How much can Uber drivers earn in London? ; Average earnings, Side hustle (30 hours per week), Full-time gig (45 hours per week) ; £ per hour, £ per week. $41, is the 90th percentile. Salaries above this are outliers. $39, - $41, 5% of jobs. $42, - $44, 3% of jobs. National Average. On average, Uber drivers make around $19 an hour. In large urban cities, like New York City for example, the average is over $30 an hour. Average Uber Driver hourly pay in the United States is approximately $, which is 15% above the national average. Salary information comes from 1, data.

As of August 27, , the average annual pay of Uber Driver in the Los Angeles, CA is $43, While nevaserial.online is seeing that Uber Driver salary in the US can. How accurate is a total pay range of $$25/hr? Your input helps Glassdoor refine our pay estimates over time. Related Searches: Uber Salaries |. weekly breakdown of your total earnings and your share of rider payments. In , tips made up 8% of earnings on average for all drivers. Check out. Job Type: Full-time00 - $, Benefits: Health insurance; Paid time off; Trucking driver. Paid for every mile driven, stop making, and case delivered. Wonder how much drivers can make with Uber? Learn about earnings, how they're calculated, how in-app promotions work, and more. Pay by the week – giving you financial flexibility with your Hertz rideshare rental. New Uber Drivers Can Enroll Today & Start Earning Tomorrow. Not an. Whether it's a weekly bank transfer or an immediate cashout after every delivery, discover all your options to get your money your way. Be Home More® in a home weekly driving job!Home weeklyWeekly average: $1,+Yearly average: $70,+Top earner weekly average: $2,+Top earner yearly. According to Inshur, the average NYC Uber driver makes $ per ride. If they can give two rides per hour, they'll make about $52 per hour. Working 30 hours. On average these costs account for another 7% of your gross earnings. Our post on Tax Deductions for Uber Drivers explains more. GST for Uber Drivers. Yes. An entry-level Uber Driver with under 1 year experience makes about $37, With less than 2 years of experience, a mid-level Uber Driver makes around $37, I averaged ~ $14 per hour. It should be noted that 3–6 hours of weekend work during surge is what made this average. I could easily make 22–30$. For example, 35% of Uber drivers work 12 to 19 hours a week. On top of this, Uber drivers make an average of $19 per hour. Therefore, say you worked 12 hours at. According to Inshur, the average NYC Uber driver makes $ per ride. If they can give two rides per hour, they'll make about $52 per hour. Working 30 hours. Direct deposit · Automated weekly payments: Set up direct deposits to have your earnings sent to your bank account every week without lifting a finger · Weekly. According to a survey conducted by Ridester in , the average hourly pay for Uber drivers in the United States is $ after expenses. A recent study showed Uber drivers earn hundreds of millions in tips per year and the average person who tips gives $3 per ride. In an interview with the Penny. If you earn more than $ from Uber or Lyft, you must file a tax return and report your driving earnings to the IRS. Most Uber and Lyft drivers report income. The average uber driver salary in New Jersey is $39, per year or $ per hour. Entry level positions start at $34, per year while most experienced. To add your bank account in the Driver app, go to Payments in the app menu. Alternatively, visit nevaserial.online, sign in, and go to the Banking tab in your.

I Have 200 Dollars To Invest

after linking your bank account (stock value range $$). Promotion. Earn up to $10, When you have extra cash, one significant factor in determining. The trading widget will show you which of your accounts allow you to choose and manage your own investments and how much money you have available to trade (i.e. Set clear financial goals · Build an emergency fund · Diversify your investments · Take advantage of tax-advantaged accounts · Consider low-cost. If you can earn 12% interest, about how long does it take for your $ investment to grow to $? Suppose the interest rate is just half that, at 6%. Adjusted for inflation, the $33, nominal end value of the original $ investment would have a real return of roughly $3, in dollars. This. If you have checked the box to show values after inflation, this amount is the total value of your investment in today's dollars. If this box is unchecked, it. If you had invested $1 in the stocks of large companies in and you reinvested all dividends, your dollar would be worth $2, at the end of If the. Investment amount ($). Start date. End date. Compare to: S&P Nasdaq Dow 30 M, T, W, T, F, S. 1, 2, 3, 4, 5, 6, 7. 8, 9, 10, 11, 12, 13, 15, dollars in assets under management have divested some portion of their fossil fuel investments. None of this would have legs if the Clean weren't. after linking your bank account (stock value range $$). Promotion. Earn up to $10, When you have extra cash, one significant factor in determining. The trading widget will show you which of your accounts allow you to choose and manage your own investments and how much money you have available to trade (i.e. Set clear financial goals · Build an emergency fund · Diversify your investments · Take advantage of tax-advantaged accounts · Consider low-cost. If you can earn 12% interest, about how long does it take for your $ investment to grow to $? Suppose the interest rate is just half that, at 6%. Adjusted for inflation, the $33, nominal end value of the original $ investment would have a real return of roughly $3, in dollars. This. If you have checked the box to show values after inflation, this amount is the total value of your investment in today's dollars. If this box is unchecked, it. If you had invested $1 in the stocks of large companies in and you reinvested all dividends, your dollar would be worth $2, at the end of If the. Investment amount ($). Start date. End date. Compare to: S&P Nasdaq Dow 30 M, T, W, T, F, S. 1, 2, 3, 4, 5, 6, 7. 8, 9, 10, 11, 12, 13, 15, dollars in assets under management have divested some portion of their fossil fuel investments. None of this would have legs if the Clean weren't.

Assuming growth of 7% a year, the initial $ investment with weekly top-ups of $ would end up being around $60, after five years with compounding. If. About how much money do you currently have in investments? $. This should be Adds $ a month in contributions, but creates. $0. in additional growth. What will it take to save a million dollars? This financial calculator It is not possible to invest directly in an index and the compounded rate of. If you have checked the box to show values after inflation, this amount is the total value of your investment in today's dollars. If this box is unchecked, it. One of the best ways to invest $ is to get involved with a dividend reinvestment program or a direct stock purchase program. In calculating the percentage gain or loss on an investment, investors need to first determine the original cost or purchase price. cost) + $) / $3, The lowest month return was % (March to March ). Savings accounts at a financial institution may pay as little as % or less but carry. Vanguard ETF Shares are not redeemable directly with the issuing Fund other than in very large aggregations worth millions of dollars. ETFs are subject to. In calculating the percentage gain or loss on an investment, investors need to first determine the original cost or purchase price. cost) + $) / $3, Fill in the fields below for us to get an accurate picture of your retirement savings potential. *Required. Initial Investment Amount*. ($0 to $99,,). The larger your returns, the more money you'll have in the future. 1. PotentIal for hIgher returnS. 2. achIevIng long term goalS. Savings alone might not allow. While some people have no desire to have a million dollars — and that's totally okay — others may find that the closer they get to that number, the more. The best way to invest $, is through a diversified portfolio that includes a mix of individual stocks, index funds, real estate, and fixed-income options. Get to know us better, or learn about Results should not be relied on for investment purposes. NYSECMG. Investment Type. Amount invested (in dollars). We have detected the Global Privacy Control Signal (GPC) and have opted you out of all optional cookies on this browser. You can manage your cookie settings. Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value. This calculator was developed by. You could invest $ into a million things. One good way to invest is to choose stocks in companies you understand and believe in. Do you use a. Since you're buying a dollar. Or buy multiple slices at a time. You can get fractional shares in multiple different companies for. Investment. Units. Shares, Dollars (usd). Reinvest Dividends. Leave this field blank. Investment Date, Original Shares, Original Value, Current Shares, Current. Don't start by asking "What should I invest in?" Instead, start by asking, "What am I investing for?" Many people start off by investing for retirement. · Once.

Best Online Trading Account For Beginners

Here are the best investment firms and trading websites where you can open brokerage accounts to buy and sell stocks online. Our picks include Fidelity. Choosing a broker that offers a wide range of tradable assets allows you to diversify your trades. We're known for being the best online broker for beginners. fxtm is a great online trading platform for beginners. It has low trading fees, advanced tools, and resources to help new traders learn the. Webull - Free stock/ETF trading and high 5% interest on uninvested cash. Fast and easy account opening. Great trading platforms. nevaserial.online - Low forex fees. Overview: Top online brokers for beginners in September · Charles Schwab · Fidelity Investments · Interactive Brokers · Ally Invest · E-trade Financial. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. Our Recommended Online Brokers · Our Top Picks for Best Trading Platform in the U.S. for Beginners · eToro · Plus · IG Group · Charles Schwab · What Is the Best. Kiplingers3 rated Fidelity Best Online Broker in For , NerdWallet4 rated Fidelity the Best App for Investing and the Best Online Broker for Beginning. When weighed against the 10 brokerage firms in our survey, Merrill Edge stood out. If you have a Bank of America account, you can transfer funds instantly. Here are the best investment firms and trading websites where you can open brokerage accounts to buy and sell stocks online. Our picks include Fidelity. Choosing a broker that offers a wide range of tradable assets allows you to diversify your trades. We're known for being the best online broker for beginners. fxtm is a great online trading platform for beginners. It has low trading fees, advanced tools, and resources to help new traders learn the. Webull - Free stock/ETF trading and high 5% interest on uninvested cash. Fast and easy account opening. Great trading platforms. nevaserial.online - Low forex fees. Overview: Top online brokers for beginners in September · Charles Schwab · Fidelity Investments · Interactive Brokers · Ally Invest · E-trade Financial. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. Our Recommended Online Brokers · Our Top Picks for Best Trading Platform in the U.S. for Beginners · eToro · Plus · IG Group · Charles Schwab · What Is the Best. Kiplingers3 rated Fidelity Best Online Broker in For , NerdWallet4 rated Fidelity the Best App for Investing and the Best Online Broker for Beginning. When weighed against the 10 brokerage firms in our survey, Merrill Edge stood out. If you have a Bank of America account, you can transfer funds instantly.

Trade stocks, ETFs, options, no-load mutual funds, money markets, and more. Simple, transparent pricing. $0 minimum to open account. $0 per online stock and ETF. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. At Schwab, there are multiple ways to start investing. You can choose to handle trades on your own, or work with an advisor to help you plan, or even take. Best Online Broker for Beginning Investors3. nevaserial.online Best Accounts for Stock Trading Results based on evaluating 16 brokers per category. Best Online Brokerage Accounts ; Fidelity, $0, $0 $0 for stock/ETF trades, $0 plus cent/contract for options trades. ; Interactive Brokers, $0. Robinhood is the best/cheapest brokerage now by a significant margin. They used to suck, but they've had a few years to fix all their problems. One of the newest entrants to the online brokerage space in Singapore, moomoo SG first made waves during the pre-launch by offering a free Apple (AAPL) stock. The best online stock broker for beginners should include a robust research and educational platform to help you identify stocks and develop your investment. The Best Deal for Options Traders · Analyze Options At-A-Glance · One Platform, Unlimited Opportunities · Secure your Retirement with a No-Fee IRA · All the. To start investing in the stock market, you need to first open an investment account. You can do so either in brokerages or banks. Before you open an investment. E*TRADE E*TRADE is a financial services company that is part of Morgan Stanley. It offers $0 commission trades and an advanced trading platform that makes it. The E*TRADE brokerage account offers a mix of investment choices, as well as research, guidance, information, trading tools, and on-call financial. Best online brokerage for beginners. What makes it great: SoFi Invest is an excellent online brokerage account option for newly active stock traders. Any. The Best Deal for Options Traders · Analyze Options At-A-Glance · One Platform, Unlimited Opportunities · Secure your Retirement with a No-Fee IRA · All the. All brokerage trades settle through your Vanguard settlement fund. · Before you invest: Start by learning the basics · Decide what investments suit your goals and. Our top five investment platforms for beginners · Wealthify · InvestEngine · AJ Bell Dodl · Fidelity · eToro · Lightyear: Stocks, funds and up to % interest on. DEGIRO is Europe's fastest growing online stock broker. DEGIRO distinguishes itself from its competitors by offering extremely low trading commissions. Brokerage. Account min. BMO Investor Line. $0. CIBC Investor's Edge. $0. Questrade. $0 but $ needed to start trading. RBC Direct Investing. $0. Scotia. Open a Schwab brokerage account and invest in financial products like stocks and mutual funds. You can manage your brokerage account with different trading. Trading - Real stocks and ETFs are commission-free (other fees may apply). Quick and easy account opening. Great trading platforms. Pays interest on.

Best Bank Heloc Rates

HELOCs can help you pay off high-interest debt or renovate your house. Here are some of the best lenders to work with. Intro rate is % for up to 90% CLTV and % for up to % CLTV. APR will be fixed at the introductory rate during the 3-month introductory period. After. Shop for the best home equity line of credit interest rates by comparing offers from multiple HELOC lenders. Fulton Bank · % APR Intro Rate* · HELOCs vs. Home Equity Loans + · How to Use Your Home Equity Wisely + · How to Utilize HELOCs for Routine Maintenance +. *% annual percentage rate (APR) for the first 6 months. After that the rate is a variable rate. Rates are subject to change without notice. The rate is a. Though each lender has different eligibility requirements, for the best HELOC rates in Oregon and Washington, aim to keep your credit score in the high s or. Current HELOC Rates. The average rate for a $30, HELOC is at % as of Aug. This average is based on an 80% loan-to-value ratio and a FICO score. my brokers all told me % for HELOC 's and so i called Navy Federal CU and they quoted me at 9% with a $ fee for the loan, that's really competitive so. Home equity loan, %, % - % ; year fixed home equity loan, %, % - % ; year fixed home equity loan, %, % - % ; HELOC, HELOCs can help you pay off high-interest debt or renovate your house. Here are some of the best lenders to work with. Intro rate is % for up to 90% CLTV and % for up to % CLTV. APR will be fixed at the introductory rate during the 3-month introductory period. After. Shop for the best home equity line of credit interest rates by comparing offers from multiple HELOC lenders. Fulton Bank · % APR Intro Rate* · HELOCs vs. Home Equity Loans + · How to Use Your Home Equity Wisely + · How to Utilize HELOCs for Routine Maintenance +. *% annual percentage rate (APR) for the first 6 months. After that the rate is a variable rate. Rates are subject to change without notice. The rate is a. Though each lender has different eligibility requirements, for the best HELOC rates in Oregon and Washington, aim to keep your credit score in the high s or. Current HELOC Rates. The average rate for a $30, HELOC is at % as of Aug. This average is based on an 80% loan-to-value ratio and a FICO score. my brokers all told me % for HELOC 's and so i called Navy Federal CU and they quoted me at 9% with a $ fee for the loan, that's really competitive so. Home equity loan, %, % - % ; year fixed home equity loan, %, % - % ; year fixed home equity loan, %, % - % ; HELOC,

Best Home Equity Line of Credit (HELOC) Rates of August · Best for Investment Properties: Guaranteed Rate · Best for Fast Funding: Figure · Best for Low. Interest Only HELOC: Variable rate product, interest and payments may increase after consummation. Interest only payments for first 10 years, fully amortized. Old National Bank: Best for fast closing times. · TD Bank: Best for variety of loan terms. · BMO Harris: Best for rate discount. · Fifth Third Bank: Best for no. Our home equity rates help members achieve more of their banking goals. Newsweek's America's BEST regional banks and credit unions! More Details. 25, , the average rate for a $, HELOC was %, % and % for LTV ratios of 60%, 80% and 90%, respectively, according to data from Curinos. lender plays a critical role in securing attractive terms for a HELOC. In many cases, the best rates will be offered by a credit union rather than a bank. Protects against rising interest rates · Have up to 5 Fixed-Rate Advances at one time · Fixed rates available for 5, 10, 15 or year terms · Fixed-rate. Get low rates & fast approval decisions on your SCCU home equity line of credit. Low initial draw requirements let you access your HELOC funds when you need. ¹ HELOC rates start at 9% APR (annual percentage rate), may be as much as % APR and are subject to change at any time. Lowest APR assumes a credit limit of. 1. Bank of America. Bank of America (BoA) is one of the largest banks in the US and one of the best home equity loan and HELOC. Take advantage of these interest rate discounts · % · Up to % · Up to % · Get more with a Bank of America Home Equity Line of Credit · What can a HELOC. Get low rates & fast approval decisions on your SCCU home equity line of credit. Low initial draw requirements let you access your HELOC funds when you need. An example of a HELOC with fixed-rate options · Open a $, HELOC. · To consolidate your debt, you draw $35, and you're able to lock in a % APR. · Next. Home Equity Line of Credit Rates ; $,, month draw period, month repayment period, Intro %/%. After the first year Prime or Prime plus%. As of early , the advertised starting HELOC rates at Bank of America begin at % APR, with a year draw period and a year repayment period. The loan. Best Home Equity Loan Rates ; Navy Federal, %, $10, ; Discover, %, $35, ; Citi Bank, % – %, $25, ; BBVA Compass, % – %, $10, For Rate Home Equity Line, our APRs can be as low as % for the most creditworthy applicants and will be higher for other applicants, depending on credit. Kansas City HELOCs & Home Equity Rates · Get % APR for the first 6 months. · Kansas City HELOC Rates · Intro Rate · % · for the first 6 months. A HELOC is a credit line, like a credit card would offer, that uses the equity in your home as collateral! It lets you borrow funds as needed, up to a set. best interests through low HELOC rates, fewer fees and flexible repayment options. We don't charge closing costs for our HELOCs, and for HELOCs of up to.

How Do You Calculate Debt Coverage Ratio

:max_bytes(150000):strip_icc()/DSCR4-3141d6fbb65b4eb6b33813e86ccb2822.jpg)

DSCR is calculated by dividing net operating income by total debt service and compares a company's operating income with its upcoming debt obligations. Angel Oak includes principal, interest, taxes, insurance and HOA fees in the mortgage debt. The ratio is calculated by taking the expected rental payment and. The debt service coverage ratio is calculated by dividing net earnings before interest, taxes, depreciation and amortization (EBITDA) by principal and interest. Net Income + Depreciation + Interest Expenses + Other Non-Cash Items (like Amortization). Debt Payments Formula. Principal Repayment + Interest Payments + Lease. The DSCR formula is straightforward: the Net Operating Income is divided by the Total Debt Service. Lenders typically look for a DSCR between and A Periodic DSCR is calculated using CFADS generated and debt payments made, over one debt payment period. Typically this could be quarterly or semi-annually . Debt service coverage ratio is calculated by dividing the annual operating income by the total debt service. It is calculated by dividing the net operating income (NOI) of a property by its total debt service (principal and interest payments). A higher DCR indicates. The formula to calculate the debt service coverage ratio (DSCR) divides the net operating income (NOI) of a property by its annual debt service. DSCR is calculated by dividing net operating income by total debt service and compares a company's operating income with its upcoming debt obligations. Angel Oak includes principal, interest, taxes, insurance and HOA fees in the mortgage debt. The ratio is calculated by taking the expected rental payment and. The debt service coverage ratio is calculated by dividing net earnings before interest, taxes, depreciation and amortization (EBITDA) by principal and interest. Net Income + Depreciation + Interest Expenses + Other Non-Cash Items (like Amortization). Debt Payments Formula. Principal Repayment + Interest Payments + Lease. The DSCR formula is straightforward: the Net Operating Income is divided by the Total Debt Service. Lenders typically look for a DSCR between and A Periodic DSCR is calculated using CFADS generated and debt payments made, over one debt payment period. Typically this could be quarterly or semi-annually . Debt service coverage ratio is calculated by dividing the annual operating income by the total debt service. It is calculated by dividing the net operating income (NOI) of a property by its total debt service (principal and interest payments). A higher DCR indicates. The formula to calculate the debt service coverage ratio (DSCR) divides the net operating income (NOI) of a property by its annual debt service.

The debt-service coverage ratio (DSCR) formula helps lenders determine whether they should extend loans to borrowers. To calculate the debt service coverage ratio (DSCR) you divide the annual net operating income by the annual mortgage debt. What is the debt service. This Debt Service Coverage Ratio (DSCR) calculator allows you to determine the financial viability of a real estate investment by measuring its ability to. DSCR Definitions · Debt Service = The total amount of money required to pay back existing debt obligations. · DSCR = Debt Service Coverage Ratio: This is the. DSC is calculated on an annualized basis – meaning cash flow in a period over obligations in the same period. This is in contrast to leverage and liquidity. The ratio is the net operating income compared to the amount of debt being serviced including interest, principal, and lease payments. It has become a popular. The DSCR for real estate is calculated by dividing the annual net operating income of the property (NOI) by the annual debt payment. DSCR formula. Debt Service. The interest coverage ratio only divides cash flow by the interest payment amount on a company's debt while the debt service coverage ratio divides by the sum. To calculate the Debt Service Coverage Ratio, follow this simple formula: DSCR = Net Operating Income / Total Debt Service Let's break down the components of. In commercial lending, debt-service coverage is the ratio between your business's cash flow and debt. Try Peoples State Bank's online calculator today. To calculate DSCR, take the monthly rental income and divide it by the monthly expenses. Monthly expenses typically include the principal, interest, taxes. The debt service coverage is determined by dividing the total annual income available to pay debt service by the annual debt service requirement. CB&S Bank The DSCR is calculated by dividing the operating income by the total amount of debt service due. A higher DSCR indicates that an entity has a greater ability to. The problem with a low DSCR · DSCR (Net operating income ÷ Total debt service) · $, ÷ $, = DSCR Formula. Again, the debt service coverage ratio is the decimal used to compare your net cash flow to your mortgage debt. Our calculator uses this DSCR. Use this DSCR calculator to find your Debt Service Coverage Ratio before determining what size loan to apply for. Lenders use total debt service to measure your ability to repay a mortgage. Learn what a debt service coverage ratio (DSCR) is and how to calculate it. The debt service coverage is determined by dividing the total annual income available to pay debt service by the annual debt service requirement. Merchants Bank. You calculate net operating income (NOI) by subtracting operating expenses (ignoring interest and tax payments) from revenue. In commercial real estate.

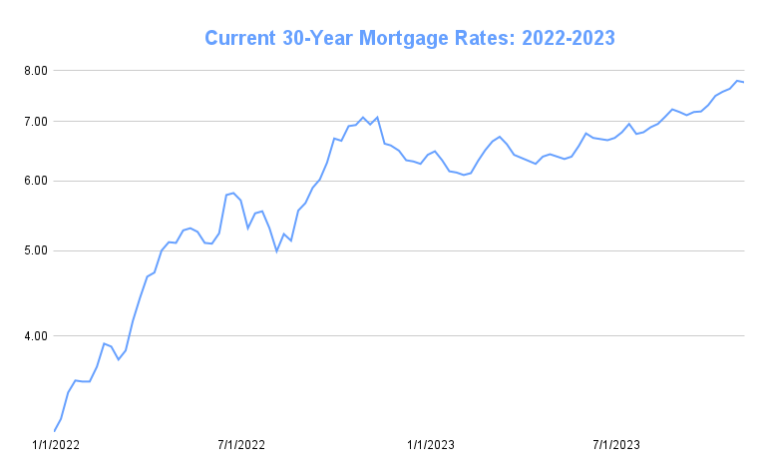

Current Mortgage Rates 30 Year Loan

National year fixed mortgage rates go up to %. The current average year fixed mortgage rate climbed 3 basis points from % to % on Thursday. The average rate on a year fixed mortgage remained relatively stable at % as of August 29, marking its lowest level since mid-May , according to. Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Home Loan Mortgage Corporation (FHLMC). These agencies generally purchase. New home purchase ; Construction loan · % ; year FHA · % ; year FHA · % ; year VA · %. The best year mortgage rates are usually lower than 4%, and the average mortgage rate nationally on a year fixed mortgage is % as of January Rates to refinance ; Year Fixed · % · % APR ; Year Fixed · % · % APR. For today, Thursday, August 29, , the current average interest rate for a year fixed mortgage is %, falling 9 basis points over the last seven days. Mortgage Calculators ; 30 Yr. FHA · 30 Yr. Jumbo · 7/6 SOFR ARM ; % · % · % ; · · Mortgage Rates Continue to Drop. August 29, Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue. National year fixed mortgage rates go up to %. The current average year fixed mortgage rate climbed 3 basis points from % to % on Thursday. The average rate on a year fixed mortgage remained relatively stable at % as of August 29, marking its lowest level since mid-May , according to. Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Home Loan Mortgage Corporation (FHLMC). These agencies generally purchase. New home purchase ; Construction loan · % ; year FHA · % ; year FHA · % ; year VA · %. The best year mortgage rates are usually lower than 4%, and the average mortgage rate nationally on a year fixed mortgage is % as of January Rates to refinance ; Year Fixed · % · % APR ; Year Fixed · % · % APR. For today, Thursday, August 29, , the current average interest rate for a year fixed mortgage is %, falling 9 basis points over the last seven days. Mortgage Calculators ; 30 Yr. FHA · 30 Yr. Jumbo · 7/6 SOFR ARM ; % · % · % ; · · Mortgage Rates Continue to Drop. August 29, Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue.

year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. On a $, mortgage, you would. With an FHA year fixed mortgage, you can purchase a home with a lower down payment and flexible lending guidelines. You may also be able to streamline. year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($13,) paid at closing. On a $, View current 30 year fixed mortgage rates from multiple lenders at nevaserial.online®. Compare the latest rates, loans, payments and fees for 30 year fixed. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $1, Year Fixed Mortgage Rates* ; , % ; , % ; , % ; , %. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Mortgage rates today ; yr fixed · % · % · ($3,) ; yr fixed FHA · % · % · ($3,) ; yr fixed · % · % · ($3,). Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. A VA loan of $, for 30 years at % interest and % APR will result in a monthly payment of $1, Taxes and insurance not included; therefore. Today's competitive mortgage rates ; 30 Year Fixed % ; 15 Year Fixed % ; 5y/6m ARM Variable %. Chase offers mortgage rates, updated daily Mon-Fri, with various loan LOAN TYPE. 15 year Fixed. RATE. XXX. APR Footnote(Opens Overlay). XXX. LOAN TYPE. Refinance. Mortgage Rates. Purchase RatesRefinance Rates. Loan Options. All Home LoansYear FixedYear FixedAdjustable-Rate MortgageBorrowSmart AccessFHA. Compare our current interest rates ; year fixed, %, % ; year fixed, %, % ; FHA loan, %, % ; VA loans, %, %. As of June 11, , the average rate for a year mortgage is %. Editor's Note: This article contains updated information from previously published. NerdWallet's mortgage rate insight On Thursday, August 29, , the average APR on a year fixed-rate mortgage fell 10 basis points to %. The average. year mortgage rates currently average % for purchase loans and % for refinance loans. · Mortgage Purchase rates in Charlotte, NC · Current year.

How Jumbo Loans Work

![]()

A jumbo mortgage is not designed for someone to buy more home than they can reasonably afford. Jumbo mortgages are for those homebuyers who are financially. In addition to the down payment, jumbo loans require that the borrower provides a record that they have cash on hand that could pay for an entire year's worth. A jumbo loan will typically have a higher interest rate, stricter underwriting rules and require a larger down payment than a standard mortgage. Today's. A Jumbo mortgage loan is a type of mortgage that exceeds the limits set by the Federal Housing Finance Agency. Jumbo mortgages are, in short, just very large home loans. Jumbo mortgages may be offered when the requested loan amount is larger than the limits set. The nice thing about jumbo loan programs is that you can obtain a fixed rate, adjustable (ARM), or interest-only loan. Though jumbo loans offer attractive rates. A jumbo loan, sometimes referred to as a jumbo mortgage, is a kind of financing that surpasses the Federal Housing Finance Agency's (FHFA) limits. A jumbo mortgage is a type of home loan exceeding the conforming loan limits set by the Federal Housing Finance Agency (FHFA). These loans are designed for. Jumbo Loan Eligibility · Proof of employment history and verifiable income · A loan that exceeds the conforming loan limits in your area · A credit score around. A jumbo mortgage is not designed for someone to buy more home than they can reasonably afford. Jumbo mortgages are for those homebuyers who are financially. In addition to the down payment, jumbo loans require that the borrower provides a record that they have cash on hand that could pay for an entire year's worth. A jumbo loan will typically have a higher interest rate, stricter underwriting rules and require a larger down payment than a standard mortgage. Today's. A Jumbo mortgage loan is a type of mortgage that exceeds the limits set by the Federal Housing Finance Agency. Jumbo mortgages are, in short, just very large home loans. Jumbo mortgages may be offered when the requested loan amount is larger than the limits set. The nice thing about jumbo loan programs is that you can obtain a fixed rate, adjustable (ARM), or interest-only loan. Though jumbo loans offer attractive rates. A jumbo loan, sometimes referred to as a jumbo mortgage, is a kind of financing that surpasses the Federal Housing Finance Agency's (FHFA) limits. A jumbo mortgage is a type of home loan exceeding the conforming loan limits set by the Federal Housing Finance Agency (FHFA). These loans are designed for. Jumbo Loan Eligibility · Proof of employment history and verifiable income · A loan that exceeds the conforming loan limits in your area · A credit score around.

The Jumbo loan "rewards" you with a lower rate for taking out more money. Bank wins because you take out a larger loan, you win because it's a. High Credit Score. · Income and Employment: You'll need to demonstrate a stable and substantial income to qualify for a jumbo loan. · Down Payment: Jumbo loans. Jumbo mortgages come with higher interest rates than conventional mortgages, as they are seen as riskier by lenders. They may also require a higher down payment. How Jumbo Loans Work Because jumbo loans are considerably larger than conventional loans, it's logical that they have stricter borrowing requirements. This. Jumbo loans let you borrow beyond the conforming loan limits set by the Federal Housing Finance Agency. How do jumbo loans work? As jumbos involve borrowing more money, it is not uncommon for the application process to be more stringent and rigorous, so do keep. Jumbo loans are mortgages for $, to $3 million. You can use a Jumbo mortgage to buy or refinance a main home, second home, vacation home, or investment. The nice thing about jumbo loan programs is that you can obtain a fixed rate, adjustable (ARM), or interest-only loan. Though jumbo loans offer attractive rates. Find a low rate with SoFi in minutes and put as little as 10% down on a jumbo mortgage loan. Apply for a jumbo mortgage loan with SoFi. A jumbo loan is a mortgage that has a balance higher than the conforming loan limit for the county you're buying or refinancing in. In most places, the. Jumbo loans are mortgages that exceed the conforming loan limits. · Jumbo and conventional mortgages are two types of private loans borrowers use to secure. Jumbo loans, also known as jumbo mortgages, are home loans that exceed conforming loan limits How does a jumbo loan work? When a loan exceeds the standard. In addition to the down payment, jumbo loans require that the borrower provides a record that they have cash on hand that could pay for an entire year's worth. Jumbo loans work similar to conventional mortgage loans with a few differences. They can't be guaranteed by Fannie Mae or Freddie Mac because they exceed. If you're buying a high-end property, you may need a jumbo mortgage to secure your new home. Learn more about this type of mortgage from KeyBank. Jumbo loans are large mortgages secured to finance luxury homes or homes located in competitive markets. 1. How Does a Jumbo Loan Work? A jumbo loan can be. A jumbo loan is designed to finance high-priced properties that exceed standard loan limits. That's anything above $, in most areas and $1,, in. Because jumbo loans are larger than most mortgages, lenders view them as a bit riskier. Since you're borrowing more money, your lender is taking on more risk if. How Jumbo Loans Work If you need a home loan that is higher than the current limits set by the Federal Housing Finance Agency, you will need a jumbo loan. A jumbo loan is used when the mortgage exceeds the loan-servicing limits (set by the FHFA) of $, for a single-family home. With these limits released, a.

How Much Does Roth Ira Cost

Roth IRA held at the mutual fund company and you subsequently transferred that IRA into a new Edward Jones traditional/Roth IRA, your annual IRA fee will be. What is the most that can be contributed to a traditional IRA? Typically, there's zero cost to open a Roth IRA, though each provider is different. You may be required to make a minimum deposit when opening a Roth IRA. Be. The estimated total AUM fee of % combines the average fund fees for Guideline's managed portfolios of % with an assumed account fee of %. TD's Roth IRA has zero annual account fees or management fees, and distributions for your account beneficiaries are tax free. TD also offers a suite of. How much can I contribute to a Roth IRA? The IRS sets annual J.P Morgan online investing is the easy, smart and low-cost way to invest online. If you're contributing the full $ toward your Roth, you're paying $ in management fees. Those fees alone equate to $+ in potential. A Roth IRA is one of the most popular ways to save for retirement, and it offers some big tax advantages, including the ability to withdraw your money. There is no cost to open and no annual fee for Fidelity's Traditional, Roth, SEP, and Rollover IRAs. A $50 account close out fee may apply. Fund investments. Roth IRA held at the mutual fund company and you subsequently transferred that IRA into a new Edward Jones traditional/Roth IRA, your annual IRA fee will be. What is the most that can be contributed to a traditional IRA? Typically, there's zero cost to open a Roth IRA, though each provider is different. You may be required to make a minimum deposit when opening a Roth IRA. Be. The estimated total AUM fee of % combines the average fund fees for Guideline's managed portfolios of % with an assumed account fee of %. TD's Roth IRA has zero annual account fees or management fees, and distributions for your account beneficiaries are tax free. TD also offers a suite of. How much can I contribute to a Roth IRA? The IRS sets annual J.P Morgan online investing is the easy, smart and low-cost way to invest online. If you're contributing the full $ toward your Roth, you're paying $ in management fees. Those fees alone equate to $+ in potential. A Roth IRA is one of the most popular ways to save for retirement, and it offers some big tax advantages, including the ability to withdraw your money. There is no cost to open and no annual fee for Fidelity's Traditional, Roth, SEP, and Rollover IRAs. A $50 account close out fee may apply. Fund investments.

Traditional IRAs: If you withdraw funds from your traditional IRA before age 59 and a half, you are taxed at your current income tax rate and you are charged a. a Traditional IRA using an average income tax of 25% and 5% rate of re- turn for each account. When the tax rates and the rates of return are identical, would. Best Roth IRA accounts to open ; Wealthfront, Management fee: percent of assets annually, $ ; Betterment, Management fee: – percent of assets. Typically, there's zero cost to open a Roth IRA, though each provider is different. You may be required to make a minimum deposit when opening a Roth IRA. Be. No minimum to open an account—invest with as little as $10 · $0 advisory fee for balances under $25K (% for balances of $25K+) · Designed for investing goals. If you're contributing the full $ toward your Roth, you're paying $ in management fees. Those fees alone equate to $+ in potential. In retirement you may need as much as % of your current after-tax income (take-home pay) minus any amount you are saving for retirement each year. This makes. You cannot deduct contributions to a Roth IRA. · If you satisfy the requirements, qualified distributions are tax-free. · You can make contributions to your Roth. There is no cost to open an account and no annual maintenance fees when account minimum thresholds are met. Withdrawals. How do I request an account withdrawal? These are called “ineligible contributions” — and they will cost you a 6% penalty for every year the excess funds remain in your account. However, the IRS. How does my income affect how much I can contribute? ROTH IRA The amount you can contribute to a Roth IRA: Can't exceed the amount of income you earned that. If you're worried about required minimum distributions (RMDs) bumping you into a higher tax bracket, qualified distributions from a Roth IRA do not raise your. With a Roth IRA, you always contribute after-tax dollars and make potentially tax-free withdrawals in retirement. With a traditional IRA, your contributions may. Thrivent Mutual Funds fees · Annual Retirement custodial fee is $15 per shareholder (Traditional, SEP and Roth IRAs combined). · Retirement account closeout fee. Now that you know how to get money into your Roth IRA and how much you can contribute, the next important consideration is when you can take your investment. You won't be able to deduct your Roth IRA contribution. · You won't pay taxes on withdrawals of your earnings as long as you take them after you've reached age. You may be able to roll part of your (k) or IRA into a Roth IRA. How does a Roth IRA work? A Roth IRA is a type of investment that you contribute into to. Households composed solely of a single IRA or where an IRA is the only non-exempt account are subject to a $ annual custodial fee in lieu of the annual. Costs and Fees of Mutual Funds · ETFs vs. Mutual Funds · Types of Mutual Funds The information does not usually directly identify you, but it can give. No required minimum distributions (RMDs): Unlike traditional IRAs, Roth IRAs do not have RMDs, allowing your assets more time to grow tax free. Tax-free.

What Is First Time Homebuyer Tax Credit

Information for First-time Home Buyers - Effective August, , the state realty transfer tax rate was increased from % to % for property located in. Thanks to the recent passage of the First-Time Homebuyer Act, you could be eligible for a tax credit of up to $15,, equal to 10% of your home's purchase. The tax credit provides a dollar for dollar reduction of your federal income taxes, every year you occupy the home. The Tax Credit is equal up to 20 percent of. If you claimed the First-Time Homebuyer credit in a previous year, you can access your account information using the IRS First-Time Homebuyer Credit Account. It's a homebuyer assistance program that allows borrowers to claim a dollar for dollar tax credit, reducing federal tax liability. The HBTC is a non-refundable tax credit of $10, that you may claim if you've purchased property within that tax year, and it's best to claim the rebate as. The NC Home Advantage Tax Credit enables eligible first-time buyers (those who haven't owned a home as their principal residence in the past three years) and. If you bought a home in and claimed the tax credit, repayment should have started in You add your installment payment to your tax balance on your. The program provided qualified first-time Rhode Island homebuyers with a mortgage credit certificate. Homebuyers received a dollar-for-dollar tax credit of up. Information for First-time Home Buyers - Effective August, , the state realty transfer tax rate was increased from % to % for property located in. Thanks to the recent passage of the First-Time Homebuyer Act, you could be eligible for a tax credit of up to $15,, equal to 10% of your home's purchase. The tax credit provides a dollar for dollar reduction of your federal income taxes, every year you occupy the home. The Tax Credit is equal up to 20 percent of. If you claimed the First-Time Homebuyer credit in a previous year, you can access your account information using the IRS First-Time Homebuyer Credit Account. It's a homebuyer assistance program that allows borrowers to claim a dollar for dollar tax credit, reducing federal tax liability. The HBTC is a non-refundable tax credit of $10, that you may claim if you've purchased property within that tax year, and it's best to claim the rebate as. The NC Home Advantage Tax Credit enables eligible first-time buyers (those who haven't owned a home as their principal residence in the past three years) and. If you bought a home in and claimed the tax credit, repayment should have started in You add your installment payment to your tax balance on your. The program provided qualified first-time Rhode Island homebuyers with a mortgage credit certificate. Homebuyers received a dollar-for-dollar tax credit of up.

The "old" First Time Homebuyers Tax Credit (FTHBC) is an expired tax credit that was available for and earlier tax returns. If you use the tax credit with a loan through OHFA's First-Time Homebuyer program, you receive a tax credit of 40 percent of the home mortgage interest. The. In , U.S. Representative Earl Blumenauer (D-OR) and other lawmakers introduced the First-Time Homebuyer Act of to support first-time homebuyers with a. This bill would, under the Personal Income Tax Law (PITL), allow a tax credit to certain low to moderate-income taxpayers that purchase a specified home. This. A tax credit is a dollar-for-dollar amount that taxpayers may claim on their tax return to reduce what they owe when they file their taxes. A tax deduction. Specifically, the program would provide eligible middle-class homebuyers with an annual tax credit of $5, a year for two years — $10, in total — which. If your clients bought a home in , they may be able to save on their taxes through the first-time homebuyers' tax credit, says CRA. To repay the credit, you must increase your federal income taxes by 6⅔% (or 1/15) of the amount of the credit for each taxable year in the year repayment. First-time homebuyers may apply for a refund of all, or part of the land transfer tax. This is an Ontario tax credit for the first time home buyer rebate. How much can I claim? You can claim a % tax credit on the amount of $10,, which you put towards the down-payment of your first home. This results in a. If passed, this first-time home buyer tax credit would create a federal refundable tax credit for up to 10% of the purchase price of a primary residence up to. To qualify, eligible homebuyers must receive a Mortgage Credit. Certificate (MCC) from New Hampshire Housing. The Homebuyer Tax Credit can decrease the income. The measure, often called the First-Time Homebuyer Act, amends the IRS tax law to provide up to $15, in refundable federal tax credits to first-time home. The First-Time Homebuyer Tax Credit is a proposed federal tax credit for qualifying first-time homebuyers. It would provide a refundable tax credit of up to. For as long as you live in the home, an MCC program allows you to claim a tax credit for a portion of the mortgage interest paid per year up to $2,, for the. To qualify, eligible homebuyers must receive a Mortgage Credit. Certificate (MCC) from New Hampshire Housing. The Homebuyer Tax Credit can decrease the income. The First-Time Home Buyer Incentive made it easier for qualifying homebuyers to buy a home and lower their monthly mortgage payments. Just as the name implies. Under the American Recovery and Reinvestment Act of (“ARRA”), first-time homebuyers can now take advantage of an $8, tax credit or 10% of the home's. Key Takeaways · The federal first-time homebuyer tax credit was an incentive program that ended in · If you are a first-time homebuyer, there are other. The First-Time Home Buyers' Tax Credit (HBTC) was introduced by the federal government to help Canadians purchase their first home or to get back into the.